Basic Concepts¶

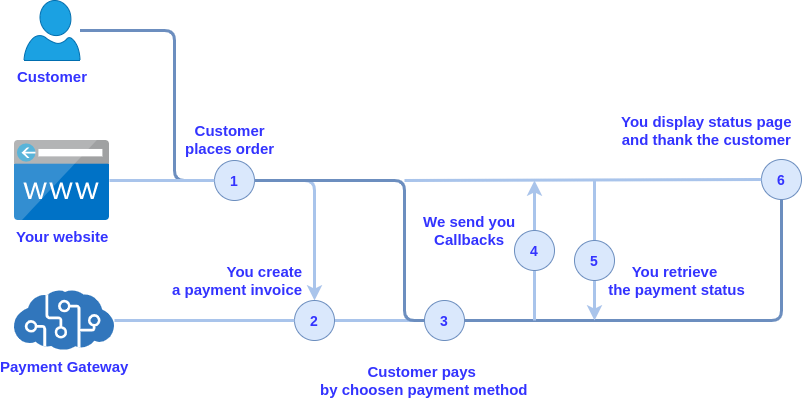

How Do Payments Work¶

- A customer on your website decides to checkout.

- Your website creates a payment invoice by calling the Spoynt API with the amount, a payment description, a Callbacks URL, and a URL we should redirect the customer to after that. In response, the API sends a list of available payment methods.

- The client chooses the service and currency and pays for the order. Spoynt takes over the transaction. In case the selected service is unavailable due to technical reasons or the client has entered incorrect data, Checkout page allows making a second payment attempt.

- During payment processing, Spoynt automatically sends Callbacks to check the payment status.

- You get Callbacks with statuses via API to the dashboard and the specified Callbacks URL.

- Having received the final status, you can display the client a page with payment status and thanks for the order. Payment comes to your selected currency account.

To create a payment invoice, you can use as both the dashboard and direct integration with API. And for interaction with your customers, use our ready-made Checkout page or develop your own hosted payment page. In any case, Spoynt ensures the security of the client’s data processing and determine the best option for carrying out the transaction.

What is a Payment Gateway¶

The primary function of a payment gateway is to validate your customer’s payment details securely, make sure the funds are available for the payment and get you paid.

A payment gateway is a service responsible for processing and routing payments. It is the equivalent of a physical point of sale terminal that lets your customer submit their payment details. It securely passes sensitive financial information from the customer to the merchant and then between the merchant and the payment provider. The payment gateway tells you whether payment provider processing approves the charge, and submits it. The payment amount is deducted from your customer’s payment account and deposited into your merchant account.

Payment System and Payment Providers, Methods, Services¶

The payment system is a set of procedures and rules, and the technical infrastructure to support them. All this commonly makes it possible to transfer money without cash from one entity to another.

Payment providers (PSP) provides services within the payment system. As services, they can offer the organization of payment reception, Internet acquiring, agency cooperation scheme, act as international or local companies, have different conditions for opening accounts.

Payment method is a method of funds transferring. PSP operate a variety of payment methods, enable to receive payments through bank cards, bank transfers, mobile payments, and electronic wallets.

In addition to various payment methods, payment providers support different currencies (national, electronic, cryptocurrency). To facilitate integration with providers and subsequent routing of payments, Spoynt uses the term of payment service that is a combination of payment method and currency. For example, payment for services in euros using the VISA QIWI wallet is handled with the qiwi_eur service.

Services include the properties and parameters properties and parameters required to initiate a payment, such as a customer’s wallet number, a card number, an authorisation data of their account. It is like a contract for the gateway protocol: the gateway can always expect the parameters listed in the service properties.

Payment and Payment Invoice¶

In terms of the Spoynt system, a payment is a transaction responsible for transferring money from the client to the merchant account. Payment uses a specific payment service to transfer funds.

Unlike payment, a payment invoice is created without a specific payment service and can be paid by any of the methods available to the client.

Payment Settings¶

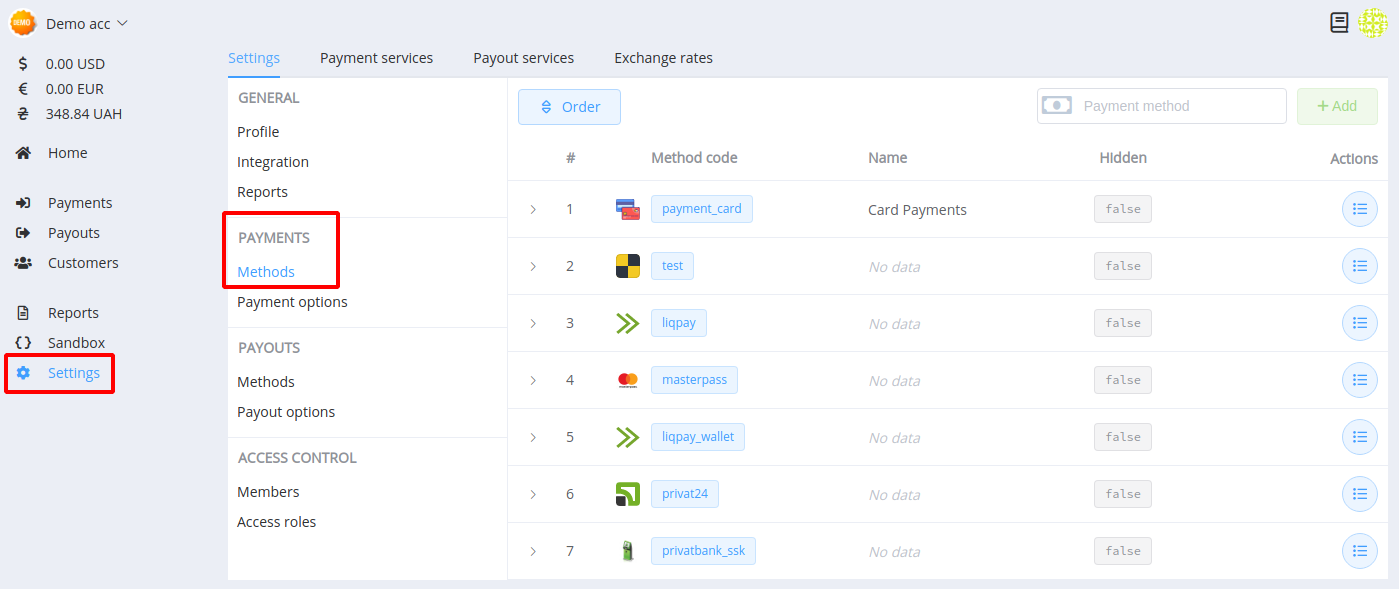

Payment Methods¶

Find a list of all available payment methods in Account Settings → Payments: Methods . Here you can enable, disable or delete the methods used, and add new ones.

Are there no available methods for payments, or not enough methods connected?

Send a request to our support to connect and configure the required methods and services.

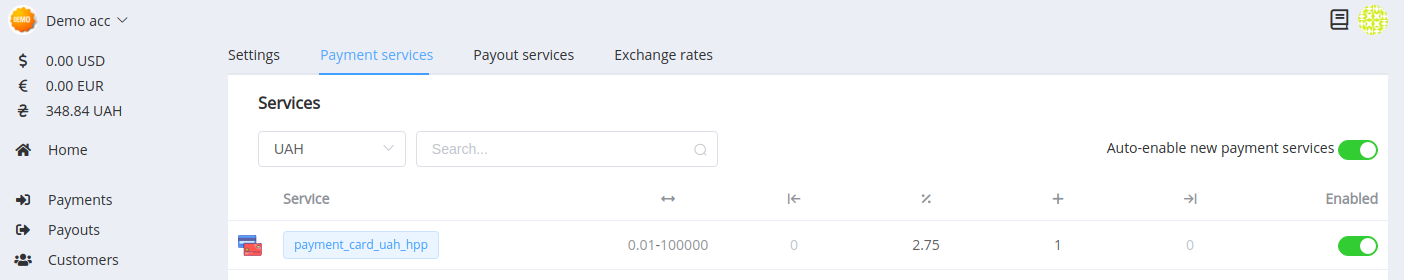

Payment Services¶

Since each payment method may have one or more services available for payment in different currencies, they are configured separately. In the Payment Services tab, you can enable access to the service, as well as view the limit values of the sum of one payment and the formulas of fee calculation.

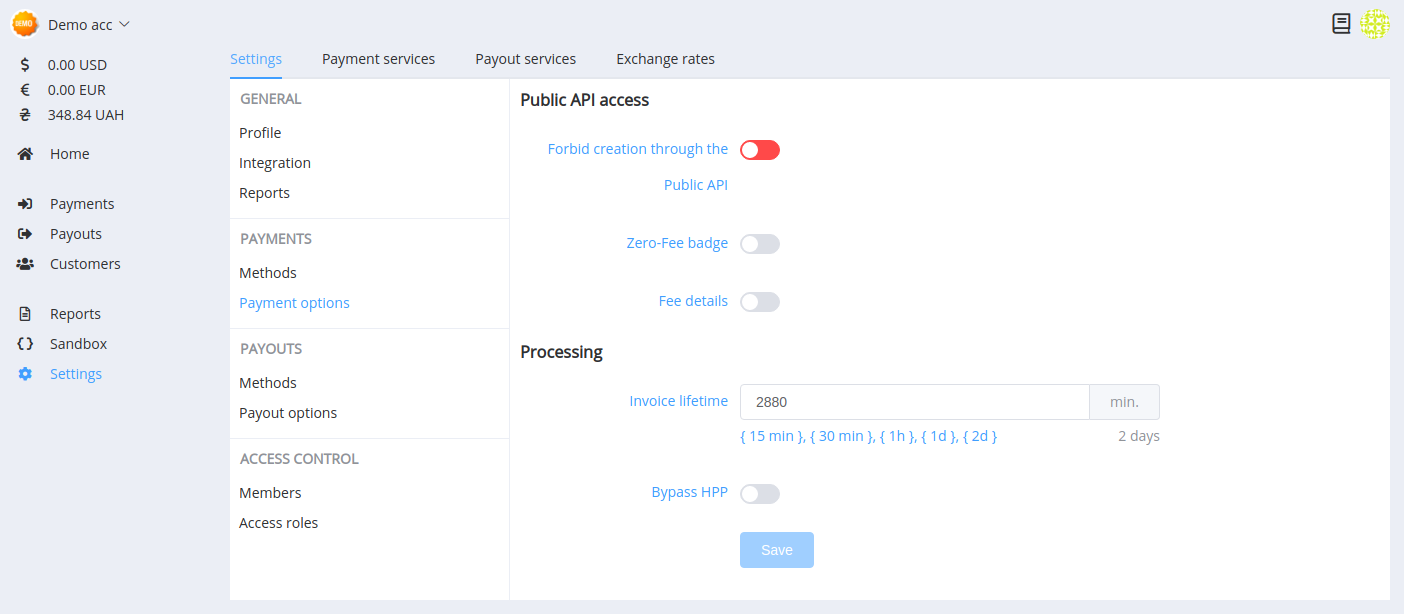

Payment Options¶

The general settings for all payment methods are in the Payments: Payment options section.

Interaction with Public API¶

- Forbid creation of payment invoices via public API: disabled by default; after activation—you can only create payment invoices through the private API.

Note

The following options do not affect the actual payment fee of the service; they modify only the information visualisation to customers ↓

Options to display payment fee on the checkout payment page:

- Zero-fee badge: the fee displays as zero

- Fee details: displays detailed fee data

Processing Settings¶

- Invoice lifetime: set in minutes, maximum period—2,880 minutes (2 days))

- Bypass HPP: after completing the payment process, the customer is redirected to the given Return URL, bypassing the payment status page (to configure Return URL, send the request to our support )